Introduction

In the modern world, universities are increasingly viewed not only as centers of knowledge and culture, but also as complex economic systems. Universities, being custodians of understanding and engines of innovation, are obliged to strive for sustainable development in order to effectively fulfill their key tasks: training highly qualified specialists, conducting scientific research and cultural activities.

One of the key factors contributing to the achievement of these goals is their own financial resources. The availability of its own funds ensures the financial independence of the university. For example, when government funding may be limited, the university's own funds allow it to independently plan development, implement new projects, and not depend entirely on external sources. The endowment also provides an opportunity to develop scientific activities and infrastructure. Modern laboratories, libraries, academic buildings, gaming stadiums, advanced technologies, etc. require significant investments. Financial resources make it possible to upgrade equipment, expand curricula, and create conditions for quality education [1].

This contributes to improving the level of teaching and research, as well as increases the prestige of the university. University funds make it possible to finance scholarships, grants, and other social programs, making the programs more accessible to talented students with financial need. Talented students also attract the best professors, which..., which ultimately has a positive effect on the general level of education, scientific achievements, and funds of the universities.

Fig. 1

In the context of globalization and increasing international competition, it is important for Russian universities to create conditions for the development of their own funds in order to increase their prestige, attract talented students and teachers, and implement research projects. In Russia, many students face serious obstacles to studying at leading universities. The high cost of studying at top universities makes them inaccessible to most people.

At the same time, the number of government grants and scholarships remains insufficient to cover the costs of students in need, which limits their ability to receive quality education. In addition, Russian universities often lack facilities similar to American ones, such as well-developed sports clubs, research, and infrastructure for outdoor activities. This reduces the attractiveness of universities and limits students' opportunities not only to study, but also to develop personal and professional skills through participation in various extracurricular activities. One can also not get a scholarship for accommodation and meals in Russia.

Moreover, people can get a scholarship to study only based on the score of the state exam. The development of funds will help universities in Russia become more independent and sustainable, which is especially important in an unstable external situation. Many foreign universities demonstrate successful fund management models, which allows them to implement large-scale projects and ensure long-term development. It is important for Russian universities to adopt these practices to increase the efficiency of using their resources and the possibilities of students.

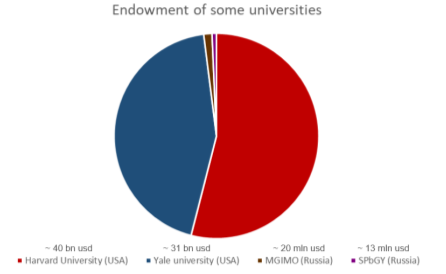

As I mentioned earlier, universities in Russia have really small endowments [2]. For example, some of the most prestigious universities such as MGIMO or St. Petersburg State University (SPbGY) have less than $25 million in their endowments, while American universities such as Harvard and Yale have endowments of more than $30 billion able 1).

- Literature Review

In 2018, Sandy Baum and Victoria Lee conducted research to better understand endowments. «At the end of academic year 2015–16, colleges and universities in the United States held endowment assets totaling about $532 billion» [3]. Many universities use part of their funds to reduce tuition and accommodation fees for low-income students. This small group of students enrolled in the most affluent and prestigious universities get unique opportunities and pay significantly less for tuition and campus than in other educational institutions.

To reduce educational inequality, it is necessary that more students from low-income families have the opportunity to study at colleges and universities with the most resources, as well as that more institutions have the means to provide quality education at affordable prices for students with limited financial resources emphasize that it is necessary to expand access to the best educational institutions for students from disadvantaged families and increase funding for universities that can provide high-quality education at a reasonable price [4].

The author calls for a more differentiated approach to investments in intellectual capital. They propose to divide them into two categories: those that can potentially be associated with financial benefits (for example, research leading to the creation of new technologies) and those that are aimed at obtaining public benefits (for example, projects aimed at solving social problems). They also urge universities to work more actively with external sponsors. Ultimately, the author emphasizes that universities should carefully weigh their goals and priorities, because effective and coordinated management of both sides of the portfolio will allow universities to make a unique contribution to the development of global science and education, which would not have been possible without their participation.

Then, one of the foundational studies on endowments related to taxes. The authors of the article, Victoria Lee and Sandy Baum, question the effectiveness of taxation of university endowments as a tool to combat educational inequality [5]. They argue that universities benefit society not only by supporting underprivileged students, but also through research and community service provision. In their opinion, the proposed taxes are unlikely to significantly expand access to education for those in need, but will only benefit well-off families. Moreover, changes in admission policies and financial aid at the wealthiest universities will have little impact on the overall picture of inequality. The authors propose to review the system of public financing by redirecting funds to support less well-off educational institutions that teach the majority of students from disadvantaged families. Ultimately, the problem of increasing educational opportunities for those in need requires a comprehensive approach, and endowment taxation is not the most effective solution.

However, Jeffrey R. Brown et al., (2014) analyze the impact of financial crises on university endowments and their implications for university operations [6]. The study shows that endowments reduce payments after negative shocks more than they are intended for. This contradicts common models that assume stable payments or the use of endowments as «airbags». The authors explain this behavior by the leadership's personal interest in increasing the size of endowments, which is confirmed by the fact that the largest reduction in payments is observed in funds close to the targets set at the beginning of the presidential term. Crises also lead to a reduction in the hiring of employees (except administrators), especially in those endowments that are close to the target values. In general, the work demonstrates that financial shocks significantly affect the endowment payment policy and the operational activities of universities, revealing a new channel of financial markets' impact on real investments. John Y. Campbell et al. (2024) are convinced that the economic approach to the formation of the university budget has significant advantages [7].

First, by linking the endowment and the university's debt to the present value of net operating expenses, he shows that a seemingly huge endowment can be fully utilized to support these expenses and is not available to finance expensive new projects. The economic approach focuses the university's management's attention on long-term strategic solutions to financial problems, rather than on short-term fixes that use financial instruments to balance one-year budgets by borrowing from the future. This approach also highlights the enormous impact of financial market conditions on endowment-dependent universities.

The issue of the use of university endowments — endowment funds invested to support educational institutions — has become particularly relevant in the context of growing educational inequality. Despite the huge resources concentrated in several prestigious universities, the allocation of these funds and the policy of their use raise questions. Thus, the use of university endowments should be strategic, transparent and aimed not only at saving capital, but also at solving social problems. Increasing the availability of quality education requires not so much the introduction of taxes as a rethink of the financing system, but the redistribution of resources and increasing the efficiency of their use. Only an integrated approach, including support for both prestigious and universities with smaller endowments, can lead to a real reduction in educational inequality and sustainable development of higher education.

- Analysis

Harvard University

«Harvard’s endowment is crucial to our excellence in teaching, learning, and research, as well as the University’s purpose-driven initiatives and partnerships on campus, in our neighboring communities, and all over the world». About 80 % of Harvard’s $53.2 billion endowment is earmarked for financial aid, scholarships, faculty chairs, academic programs or other projects, according to the school. The remaining 20 % is intended to sustain the institution for years to come. Harvard's endowment, managed by the Harvard Management Company (HMC), primarily invests in public equities, private equity, real estate, natural resources, and hedge funds. While specific public holdings change frequently, as of mid-2025, top public equity investments included major tech companies like Microsoft and Amazon, but there was also a significant shift into Bitcoin and Gold through new investments in the iShares Bitcoin Trust ETF and SPDR Gold Shares ETF. Notably, Harvard shows substantial diversification efforts, having invested in companies based not only in the U. S. but also in countries like India and Indonesia, among others. Its most notable investments include companies like Leap, Westfalia Fruit and Moglix.

Yale university

Yale University's endowment was valued at $41.4 billion as of June 30, 2024, making it the second-largest university endowment in the U. S. behind Harvard's. The Yale Endowment is the product of more than 300 years of generosity and is sustained by disciplined spending and prudent investment management. «The Endowment supports every facet of our university, and contributes roughly a third of Yale’s annual operating budget». Yale's endowment investments are characterized by the «Yale Model», which emphasizes long-term, illiquid, and alternative assets like private equity, venture capital, and real estate, moving away from traditional stocks and bonds. Yale's endowment has been widely criticized for its investments in fossil fuel companies, Puerto Rican debt, private prisons, companies which provide services to Immigration and Customs Enforcement, and subprime mortgage lending companies, The biggest single position that Yale has been shopping for is a roughly $600 million stake in a 2007 fund run by Golden Gate Capital.

University of Pennsylvania

Penn’s endowment provides critical support for the University’s goal of becoming the most inclusive, innovative, and impactful university in the world. Totaling $22.3 billion as of June 30, 2024, the endowment comprises over 8,800 individual endowment funds benefiting the University’s schools, centers, and the University of Pennsylvania Health System. The majority of Penn's endowment is invested in the AIF, which is a pooled investment vehicle managed by the Penn Office of Investments. However, UPenn doesn't typically invest directly in specific public companies, but rather through various investment vehicles and specialized funds such as the Penn Medicine Co-Investment Program and the Fund for Health. Penn also supports portfolio companies through dedicated venture funds like Dorm Room Fund and Red & Blue Ventures.

– Diversification is a key investment strategy: All three universities actively seek to diversify their investment portfolios. While specific assets and approaches may vary (e.g., publicly traded stocks at Harvard versus Yale's emphasis on alternative investments), the overall goal is to mitigate risk and maximize long-term returns by allocating capital across different asset classes, geographic regions, and investment strategies.

– Long-term sustainability is a central goal: Endowment management at all three universities prioritizes long-term sustainability. Investments are made with the intention of generating revenues that will preserve and grow the endowment over time, ensuring that the universities can continue to benefit from this financial resource for future generations. A portion of the endowment is specifically designed to maintain the university's sustainability for years to come.

– Balancing growth with ethical considerations: Although this is not explicitly stated for all three, the information suggests a growing awareness of the ethical aspects of endowment investing.

– Yale's endowment, in particular, has been criticized for its investments in areas such as fossil fuels, private prisons, and other companies. This highlights the challenge of balancing the goal of maximizing financial returns with the desire to align investments with the university's values and social responsibility. This tension is likely present to varying degrees in all three institutions.

Recommendations to Russian universities

By following these recommendations, Russian universities can develop reliable and sustainable endowment funds that will support their academic excellence and contribute to the country's economic and social development.

– Articulate a clear vision of the endowment's role in supporting the university's mission and strategic goals: Develop a clear and transparent policy for endowment spending, investment allocation, and reporting. This will enhance the trust of investors and stakeholders.

– Seek partnerships with corporations and foundations: Develop relationships with corporations and foundations to secure grants and donations. Align the university's research programs with their philanthropic priorities.

– Focus on long-term growth: Emphasize long-term, sustainable returns rather than short-term gains. Align investment decisions with the endowment's long-term mission.

– Engage stakeholders: Collaborate with alumni, faculty, students, and other stakeholders to gather feedback and ensure that the endowment aligns with the university's mission and values.

– Diversify asset classes: Distribute their investments across a range of asset classes, including stocks, bonds, real estate, and alternative investments (such as private equity and venture capital).

References:

- Investopedia — «How Do University Endowments Work?»

- The Potanin Foundation — Endowments in Russia: what is it and how to develop it?

- Sandy Baum and Victoria Lee — Understanding endowments

- Caroline M. Hoxby — Endowment Management Based on a Positive Model of the University

- Sandy Baum and Victoria Lee — The Role of College and University Endowments

- Jeffrey R. Brown, Stephen G. Dimmock, Jun-Koo Kang, and Scott J. Weisbenner — How University Endowments Respond to Financial Market Shocks: Evidence and Implications

- John Y. Campbell, Jeremy C. Stein, and Alex A. Wu — Economic budgeting for endowment-dependent universities.