This paper analyzes the current state of the investment and financial system of the Republic of Kazakhstan and identifies key challenges. Specific measures are proposed to improve the investment climate, such as the reform of financial institutions and the implementation of modern digital financial technologies. The study also highlights the need to attract foreign investment by improving legal mechanisms and enhancing transparency.

Keywords: modern digital financial technologies, comparative analysis, statistical modeling, artificial intelligence, reform of financial institutions.

В работе рассматривается анализ текущего состояния инвестиционной и финансовой системы Республики Казахстан, выявление ключевых проблем. Предлагаются конкретные меры по улучшению инвестиционного климата, такие как реформа финансовых институтов, внедрение современных цифровых финансовых технологий. Также выделена необходимость привлечения иностранных инвестиций через улучшение правовых механизмов и прозрачности.

Ключевые слова: современные цифровые финансовые технологии, сравнительный анализ, статистическое моделирование, искусственный интеллект, реформа финансовых институтов.

This article discusses the relevance of improving the investment climate and financial system for Kazakhstan’s sustainable development in the context of modern economic growth and globalization. The main objective is to analyze the current state of the investment and financial system in Kazakhstan, identify key problems, and propose strategic development directions based on global and regional challenges.

The research methods include comparative analysis, statistical modeling, expert evaluation, and SWOT analysis [12]. Data from national and international economic reports were also considered.

- Investment Policy and the Financial System: Current Landscape

The financial system and investment activity form the foundation of economic growth and development in any country. In the Republic of Kazakhstan, this sector plays a particularly critical role, as the country is undergoing a strategic transformation from a resource-based economy to one that is diversified, technologically advanced, and innovation-oriented. Achieving this transformation is impossible without a consistent influx of investments, the modernization of financial infrastructure, and the creation of a stable and transparent business environment. These elements are essential for ensuring long-term economic sustainability, stimulating job creation, and improving the quality of life for the population.

The economic development of any country is impossible without a stable financial system and a continuous inflow of investments. For the Republic of Kazakhstan, this is particularly relevant: the country is endowed with abundant natural resources, a strategically advantageous geographical location, and significant potential for attracting investors. However, to make the most of these advantages, it is essential to develop a well-considered strategy in the field of finance and investment.

In recent years, the Republic of Kazakhstan has been actively developing its banking sector, improving the investment climate, and integrating digital technologies into the economy. The government's priorities extend beyond achieving economic growth; they include sustainable development, in which finance and investment play a pivotal role.

The financial system and investment policy are fundamental to ensuring the sustainable economic growth of the Republic of Kazakhstan. The development of the financial sector, the increase in investment volumes—particularly foreign direct investment—and the implementation of a national strategy for economic modernization serve as the foundation for the country’s global competitiveness. This article examines the current state of finance and investment in Kazakhstan and explores strategic directions for their further development.

Despite recent progress, the country continues to face several challenges. These include dependence on raw materials, uneven regional development, and limited access to financing for small and medium-sized enterprises (SMEs). The government is undertaking reforms aimed at addressing these issues by fostering both foreign and domestic investment and creating the infrastructure necessary for a digitalized economy.

2. The Financial System of the Republic of Kazakhstan: Structure and Functions

The financial system of the country consists of several key components:

— the banking sector;

— the insurance market;

— the stock market;

— public finance;

— non-bank financial institutions.

The banking sector traditionally plays a leading role, as banks provide credit to the economy, manage household savings, and facilitate payment operations. Banks account for approximately 79 % of the total assets of the financial system [13]. In 2023 alone, the total assets of the banking sector increased by 15.4 %, reaching 51.439 trillion tenge [14].

The insurance market is developing slowly but steadily. Its main segments include mandatory motor insurance, health insurance, and property insurance. The stock market is currently in a growth phase: the number of issuers and available instruments is gradually increasing, although the overall volume of operations remains relatively low compared to developed economies.

Public finance comprises the budgetary system, tax authorities, government funds, and subsidies. The Government of the Republic of Kazakhstan actively finances infrastructure projects, supports socially vulnerable population groups, and promotes private investment through incentives and guarantees.

3. The Financial System of the Republic of Kazakhstan: Current State

The financial system of the Republic of Kazakhstan comprises banks, microfinance organizations, insurance companies, and the stock market. Its primary objective is to ensure the availability and security of financial services for both the population and businesses.

In recent years, there has been a noticeable increase in lending, particularly to small and medium-sized enterprises. As of early 2024, the volume of loans had grown by 16.7 %, reaching 11.246 trillion tenge, including 9.097 trillion tenge in the national currency and 2.148 trillion tenge in foreign currencies [14]. Banks are actively introducing digital services, allowing individuals to manage their finances online. At the same time, the state—through the National Bank and the Agency for Regulation and Development of the Financial Market—monitors the stability of the financial system and ensures the protection of consumer rights.

4. Current State of the Investment Climate

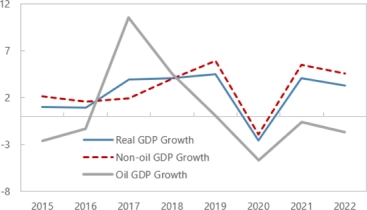

The Republic of Kazakhstan attracts investor interest due to its abundant natural resources (oil, gas, uranium, non-ferrous and rare earth metals), its strategic location between Europe and Asia, and its political stability. Growth in both oil and non-oil GDP reached 3.2 % by the end of 2022 and is projected to reach 4.2 % [15]. This trend is illustrated in pic. 1.

Pic. 1. Growth of oil and non-oil GDP [5, с. 5]

In recent years, the inflow of foreign direct investment (FDI) has ranged between USD 15 and 25 billion annually. In the first ten months of 2024, FDI reached USD 16.3 billion, with 49 new projects launched and over 17,000 jobs created [16]. Amid global economic instability and intense competition for capital, Kazakhstan has maintained a stable FDI inflow, reinforcing its position as a leading investment destination in the Central Eurasian region. Among the largest investors are Qatar (USD 11 billion), China, Turkey, Australia, and Germany. These countries are implementing both infrastructure and technology projects, including the construction of gas processing plants, logistics hubs, and rare earth metal production facilities. The main investment sectors remain consistent: energy (USD 6.5 billion), transportation and warehousing (USD 5.9 billion), and metallurgy (USD 2.1 billion). There is also sustained interest in renewable energy, food production, business services, and R&D projects. As part of this study, more than 100 international investors were surveyed. Among them, 73 % are already operating in Kazakhstan, while 46 % of those not yet present plans to enter the market in 2025. Notable projects include the launch of Carlsberg’s USD 50 million production site, the first phase of the Zhetysu Wolframy plant with an investment of USD 450 million, and the establishment of the Wan Sheng ceramic tile factory in Shymkent [17]. These developments reflect the country’s positive perception as a destination for long-term investment. According to survey respondents, the most important factors in choosing an investment jurisdiction include the qualifications and availability of the workforce, transparency and stability of the legal and tax environment, political stability and regulatory predictability, developed infrastructure, and access to markets.

To improve the investment climate, the Republic of Kazakhstan is pursuing economic liberalization, reducing administrative barriers, and creating specialized institutions to support investors. Among them is the national company «Kazakh Invest», which provides support for investment projects through a «one-stop shop» principle.

Kazakhstan seeks to attract both domestic and foreign investors by lowering administrative barriers and offering tax incentives.

The country has established special economic zones and the «Astana International Financial Centre»(AIFC), which provides investors with a favorable working environment and modern infrastructure. Priority investment areas include extractive industries, agriculture, transport and logistics, and energy, including the development of green technologies.

5. Astana International Financial Centre (AIFC)

One of the key elements of Kazakhstan’s investment attraction strategy is the establishment of the Astana International Financial Centre (AIFC) [18].

Operating since 2018, the AIFC offers investors a special legal regime based on English common law, an independent court, and international arbitration. Within its jurisdiction, companies benefit from tax incentives, including exemptions from corporate income tax for a certain period, and liberalized currency regulations that simplify cross-border operations.

The Astana International Exchange (AIX) operates under the AIFC umbrella and provides local and foreign companies with access to capital markets. One of the most notable examples of its success is the IPO of Kaspi.kz, which was listed on both AIX and Nasdaq, demonstrating Kazakhstan’s increasing integration into the global financial infrastructure.

The AIFC is also expanding into new financial sectors, including: Islamic finance; green and sustainable investment; start-up support and development of the fintech ecosystem [19]. By creating a transparent, modern, and innovation-friendly environment, the AIFC not only enhances Kazakhstan’s appeal for traditional institutional investors, but also positions the country as a regional financial hub open to new technologies and sustainable finance. This diversified development strengthens Kazakhstan’s role in the global financial system and supports the country’s long-term economic goals.

6. Government Strategy and Development Programs

Several major strategic documents have been developed to guide the long-term development of Kazakhstan’s financial and investment sectors:

— Kazakhstan 2050 Strategy — aims to position the country among the world’s top 30 developed nations by reducing dependency on raw materials and modernizing the economy;

— Digital Kazakhstan Program — focuses on the development of digital services, including financial technologies and online banking;

— National Investment Attraction Project — includes infrastructure development, tax incentives, and guarantees to encourage investor engagement;

— Industrial-Innovative Development Program — supports non-resource-based manufacturing and innovation.

The government of Kazakhstan recognizes the importance of these challenges and is actively addressing them. The national economic development strategy includes the following key priorities:

— Diversification — promoting various sectors to reduce reliance on oil and gas;

— Advancement of digital technologies, especially in the financial sector;

— Support for small and medium-sized enterprises (SMEs) through improved access to finance;

— Attraction of foreign investors via transparent regulations and robust protection of investor rights.

7. Challenges and Issues in the Financial and Investment Sectors

Despite notable progress, Kazakhstan’s financial and investment systems continue to face a number of significant challenges:

— Dependence on commodity exports. Fluctuations in global oil and metal prices, global inflation, and geopolitical tensions have a strong impact on budget revenues and investment activity. These are key external risks;

— Low economic diversification. Many non-extractive industries remain underdeveloped, limiting the resilience of the economy;

— Uneven distribution of investments across regions. Not all entrepreneurs have equal access to affordable loans. A disproportionate share of investments is concentrated in Almaty, Astana, and oil- and gas-producing regions;

— Limited access to finance for SMEs. Banks often impose high collateral requirements and interest rates, which restricts the growth of small and medium-sized businesses;

— Underdevelopment of the capital market. Both individuals and companies rarely use stocks and bonds as investment tools, preferring to keep funds in bank deposits or in cash. The general public remains financially uninformed and cautious about investing;

— Corruption and administrative barriers. Despite ongoing reforms, bureaucracy continues to hinder business processes and discourage investors.

8. Banking Sector and Digitalization

Kazakhstan’s banking system has undergone several stages of reform and consolidation. Today, dozens of commercial banks operate in the market, with the largest institutions holding a significant market share. Special attention is given to digitalization. Online banking and mobile applications have become the primary channels through which clients interact with banks. Among the leaders in digital services are Kaspi Bank JSC, Halyk Bank JSC, Bank CenterCredit JSC, and ForteBank [20].

In addition to banks, microfinance organizations, credit cooperatives, and payment systems are also actively developing. This expansion enhances the availability of financial services, especially for people living in the regions.

9. Financial Technologies and Innovation

The fintech sector in the Republic of Kazakhstan is rapidly evolving. Electronic wallets, payment services, and online lending platforms are becoming increasingly widespread. The Digital Kazakhstan program promotes the adoption of blockchain technologies, big data, and artificial intelligence in financial services. The National Bank is actively working on the launch of the digital tenge, the national digital currency.

Fintech solutions help reduce transaction costs, expand financial accessibility, and enhance the global competitiveness of Kazakhstan’s financial institutions.

10. Green and Sustainable Investments

The global trend toward environmental and social sustainability is also shaping developments in the Republic of Kazakhstan. The country has set goals to reduce carbon emissions and increase the share of renewable energy sources. The Astana International Financial Centre (AIFC) actively promotes green bonds and ESG investing. One of the challenges to attracting investment lies in the outdated infrastructure—most of Kazakhstan’s power generation and transmission systems date back to the Soviet era. Rising energy consumption puts strain on the grid, leading to blackouts and raising concerns among potential international investors [21]. To address this, further development of wind and solar power stations is essential, supported by international financial institutions such as the EBRD, the World Bank, and the Asian Infrastructure Investment Bank. This area is crucial for attracting long-term investment and strengthening Kazakhstan’s competitiveness in the global economy.

11. Promising Directions for Development

For sustainable growth and financial stability, the Republic of Kazakhstan needs to:

— Diversify the economy by developing processing industries and manufacturing;

— Support domestic small and medium-sized enterprises (SMEs) through preferential lending and streamlined procedures;

— Develop the stock market by expanding its capabilities and improving financial literacy, thereby strengthening public trust in financial institutions;

— Attract more foreign investors by improving the legal framework and lowering entry barriers;

— Promote green and digital finance;

— Optimize administrative procedures, particularly those related to obtaining investment incentives;

— Enhance the predictability of tax and customs legislation, and strengthen communication with government agencies by clarifying support measures;

— Implement digitalization to reduce administrative burdens;

— Decrease reliance on raw material exports.

Conclusion

In conclusion, it is important to emphasize once again that the financial system and investments are an integral and undoubtedly crucial part of the Republic of Kazakhstan’s economic strategy. The government is taking significant steps to create a favorable environment, but much work still lies ahead.

A strong and resilient financial system, a diversified economy, the development of fintech and green investments will help Kazakhstan strengthen its position in the region and ensure a decent standard of living for its citizens.

References:

- Kazakhstan 2050 Strategy. Astana, 2012.

- Digital Kazakhstan Program, Ministry of Digital Development of the Republic of Kazakhstan.

- National Bank of the Republic of Kazakhstan. Annual Reports (2022–2024). www.nationalbank.kz

- Agency for Regulation and Development of the Financial Market of the Republic of Kazakhstan. Official data. www.finreg.kz

- OECD (2023). Insights on the Business Climate in Kazakhstan. www.oecd.org

- EY (2024). Kazakhstan Investment Attractiveness Survey. www.ey.com

- Astana International Financial Centre. Официальный сайт. www.aifc.kz

- Asian Development Bank (ADB). (2023). Country Partnership Strategy: Kazakhstan. www.adb.org

- The World Bank (2023). Kazakhstan Economic Update. www.worldbank.org

- IMF (2024). Republic of Kazakhstan: Staff Report for the 2024 Article IV Consultation. www.imf.org

- EBRD (2023). Transition Report Kazakhstan. www.ebrd.com

- https://www.specialeurasia.com/2025/05/04/kazakhstan-fdi-economy/?utm_

- https://www.elibrary.imf.org/view/journals/002/2024/054/article-A001-en.xml?utm_

- https://interfax.com/newsroom/top-stories/103371/?utm_

- https://www.elibrary.imf.org/view/journals/002/2024/048/article-A001-en.xml?utm_

- https://www.ey.com/en_kz/newsroom/2025/04/kazakhstan-investment-attractiveness-2024-steady-interest-from-investors?utm_

- https://astanatimes.com/2025/03/kazakhstan-reports-growth-in-foreign-investment-in-2024/?utm_

- https://en.wikipedia.org/wiki/Astana_International_Financial_Centre?utm_

- https://aifc.kz/about-gfc/

- https://raexpert.ru/researches/banks_kz_2024/

- https://www.bourseandbazaar.org/articles/2023/2/28/ageing-energy-infrastructure-is-holding-central-asia-back